Home equity refinance rates determine how much it costs to refinance your mortgage while tapping into the equity you’ve built in your home.

These rates affect everything from your monthly payment to the total interest you’ll pay over time.

Because home equity refinances often involve higher loan balances and different risk levels than standard refinances, their rates work a little differently.

This guide explains how home equity refinance rates are set, what influences them, and how to evaluate whether refinancing your equity makes financial sense.

What a Home Equity Refinance Is

A home equity refinance replaces your existing mortgage with a new, larger loan and allows you to access part of your home’s equity as cash.

This is commonly referred to as a cash out refinance, even though some homeowners simply restructure their loan while still using equity as part of the qualification.

How Home Equity Refinance Rates Differ From Standard Refinance Rates

Home equity refinance rates are typically higher than standard rate-and-term refinance rates.

The reason is simple: lenders are allowing you to borrow more money against your home, which increases risk.

This pricing difference is why comparing cash out refinance interest rates vs standard refinance is essential before deciding.

Key Factors That Influence Home Equity Refinance Rates

Several factors determine your actual home equity refinance rate:

- Credit score and payment history

- Loan-to-value (LTV) after refinancing

- Debt-to-income (DTI) ratio

- Property type and occupancy

- Market interest rate conditions

The stronger your financial profile, the closer your rate may be to standard refinance pricing.

Loan-to-Value (Equity) Has the Biggest Impact

Loan-to-value (LTV) plays a major role in pricing. Most lenders limit home equity refinances to 70%-80% LTV, depending on the loan program.

Higher LTVs usually mean higher rates because the lender has less equity protection if home values fall.

Credit Score and Rate Pricing

Higher credit scores generally lead to lower home equity refinance rates. While equity provides security, lenders still rely heavily on credit to assess repayment risk.

Improving your credit score before refinancing can often save more money than waiting for a slightly better market rate.

Home Equity Refinance Rates vs HELOC Rates

Home equity refinance rates differ from HELOC rates in important ways:

- A refinance usually offers fixed rates and predictable payments

- HELOCs often have variable rates that can rise over time

Comparing refinance vs heloc which is better helps determine which option fits your risk tolerance and cash-flow needs.

Home Equity Refinance vs Home Equity Loan Rates

A home equity refinance replaces your entire mortgage, while a home equity loan adds a second loan on top of your existing mortgage.

Refinance rates are often lower than second-lien loan rates, but they reset your mortgage terms.

Reviewing refinance vs home equity loan key differences clarifies which structure costs less long-term.

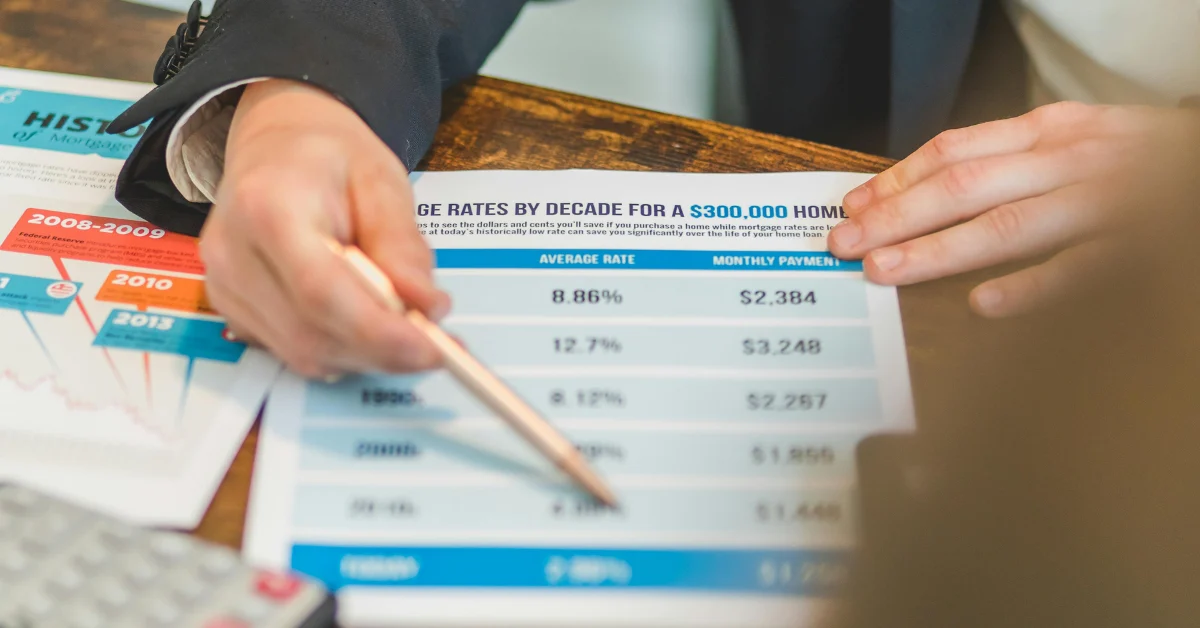

How Market Conditions Affect Home Equity Refinance Rates

Home equity refinance rates move with broader mortgage markets, influenced by inflation expectations, bond yields, and lender risk appetite.

When overall refinance rates fall, equity refinance rates usually fall too but they often maintain a small premium due to higher loan balances.

Rate vs APR: What You Should Compare

Interest rate alone doesn’t reflect the full cost. APR includes fees, points, and lender charges, giving a clearer picture of total borrowing cost.

This is especially important for equity refinances where closing costs can be higher.

When Home Equity Refinance Rates Make Sense

A home equity refinance often makes sense when:

- You’re replacing high-interest debt with lower mortgage interest

- You’re funding value-adding home improvements

- You plan to stay in the home long enough to recover closing costs

- You still retain meaningful equity after refinancing

In these cases, the refinance can improve overall financial stability.

When Home Equity Refinance Rates May Not Be Worth It

It may not be worth refinancing equity when:

- Rates are only slightly better than your current loan

- Closing costs erase most savings

- Cash is used for non-essential spending

- You plan to sell or move soon

In these scenarios, alternatives like HELOC or smaller loans may be safer.

How to Evaluate Your Home Equity Refinance Rate

Before proceeding, compare:

- Current vs new monthly payment

- Total interest over the loan term

- Equity remaining after refinancing

- Alternative financing options

Using calculating mortgage refinance savings helps convert rate comparisons into real financial outcomes.

Conclusion

Home equity refinance rates balance opportunity and risk. While they’re usually higher than standard refinance rates, they can still offer powerful savings when used to eliminate expensive debt or fund long-term improvements.

The key is not just finding a competitive rate, but ensuring the refinance strengthens your financial position without sacrificing too much equity.

When evaluated carefully, a home equity refinance can be a strategic financial tool, not an expensive shortcut.