A Mortgage Repayment Calculator helps you estimate how much you need to repay each month on a mortgage based on the loan amount, interest rate, and mortgage term.

It also shows the total amount repaid over the life of the loan, making it easier to understand the long-term cost of borrowing.

This calculator focuses on standard repayment mortgages where each payment reduces both interest and principal.

It’s commonly used by home buyers and homeowners comparing different mortgage terms or planning budgets before applying for a loan.

Mortgage repayment calculators are especially popular in markets where “repayment” is the standard mortgage terminology.

Mortgage repayment calculations assume a fixed interest rate and consistent monthly payments. Actual repayments may change due to rate adjustments, lender fees, or refinancing. Always confirm repayment details with your lender.

Important: This mortgage repayment calculator provides estimated results for informational purposes only and does not constitute financial advice or a loan offer. Actual mortgage repayments may vary. Please review our Disclaimer for complete details.

Looking to calculate your monthly mortgage repayments? Our Mortgage Repayment Calculator helps you estimate how much you need to pay each month, including principal and interest.

It’s perfect for homebuyers, refinancers, and property investors who want a clear view of their repayment obligations.

Mortgage Repayment Calculator

A Mortgage Repayment Calculator helps you estimate how much you’ll repay each month on a home loan based on the loan amount, interest rate, and loan term.

For many borrowers, this number becomes the foundation of their home-buying or refinancing decision.

But the most important part isn’t the repayment amount itself, it’s understanding how sustainable that repayment is over time and how it fits into your broader financial picture.

What a Mortgage Repayment Actually Covers

The repayment shown by a mortgage repayment calculator typically includes:

- Principal repayment (the loan balance being reduced)

- Interest charged by the lender

This gives you a clear view of your core loan obligation, but it does not represent your full monthly housing cost.

Items such as property taxes, homeowners insurance, escrow adjustments, and association fees are usually handled separately.

To avoid underestimating your real commitment, many borrowers compare this figure with a mortgage payment estimate that includes additional costs.

Why Repayment Amount Matters More Than Home Price

Many buyers focus heavily on the home price, but lenders and long-term affordability depend far more on the monthly repayment.

Two homes with the same price can have very different repayments due to:

- Interest rate differences

- Loan term length (15 vs 30 years)

- Down payment size

This is why tools like how much house you can afford and what monthly payment is safe are often reviewed alongside repayment calculators.

The Impact of Loan Term on Repayments

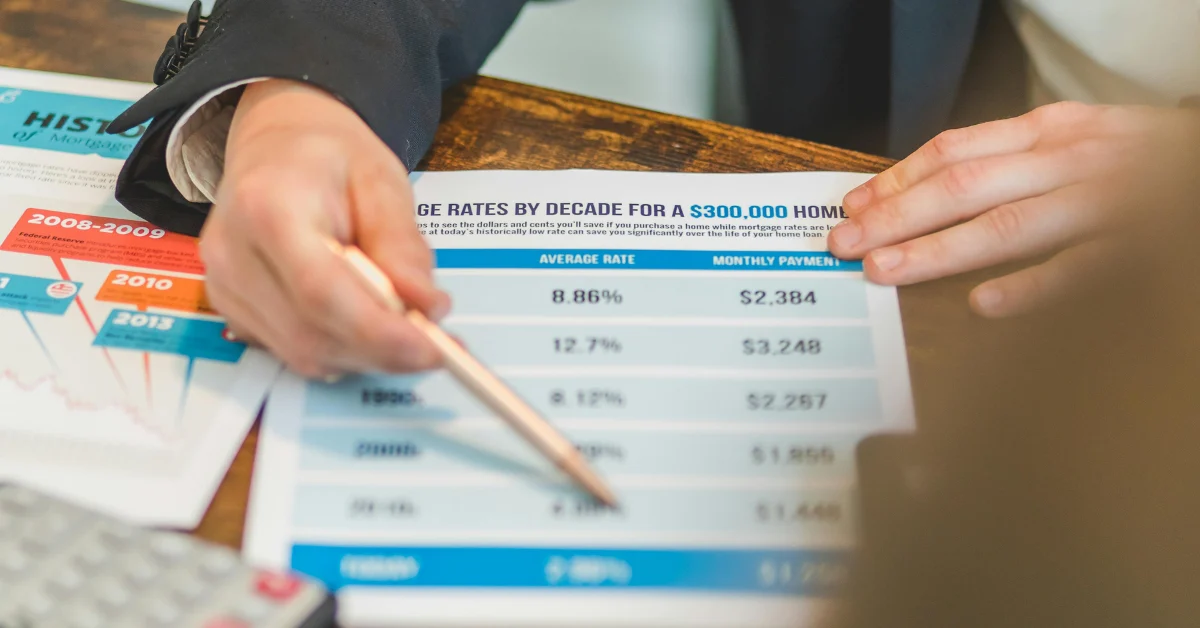

One of the biggest drivers of your repayment amount is the loan term:

- Longer terms lower monthly repayments but increase total interest

- Shorter terms raise monthly repayments but reduce interest dramatically

A mortgage repayment calculator helps you see this trade-off clearly.

Borrowers deciding between terms often review 30-year vs 15-year rate comparisons to understand how repayment comfort compares with long-term cost.

Who Should Use a Mortgage Repayment Calculator?

This calculator is especially useful if you are:

- Budgeting before buying your first home

- Comparing different loan terms

- Evaluating whether a repayment feels comfortable

- Planning for refinancing scenarios

If you’re early in the journey, understanding mortgage basics explained can help you interpret the repayment figure with more confidence.

Common Assumptions This Calculator Helps Correct

Using a mortgage repayment calculator early helps prevent mistakes such as:

- Assuming lender approval equals affordability

- Ignoring how interest rate changes affect repayments

- Choosing a loan term without understanding long-term cost

- Budgeting too close to your financial limit

Borrowers who later refinance often realize these early assumptions matter when evaluating when refinancing makes sense.

How to Use This Calculator?

The most effective way to use a Mortgage Repayment Calculator is to:

- Find a repayment that feels comfortable, not stretched

- Stress-test repayments with slightly higher interest rates

- Compare different loan terms side by side

- Leave room for taxes, insurance, and life changes

Many homeowners later use repayment figures as a baseline when reviewing refinance payment comparisons or break-even timelines.

Frequently Asked Questions

Conclusion

A Mortgage Repayment Calculator is a planning tool, not a permission slip to borrow the maximum amount a lender allows. The strongest mortgage decisions are made when repayments fit comfortably into your life today and remain manageable if circumstances change.